Major Markets Close Change % Chg Date

$NYA NYSE Composite 5,214.71 -265.17 -4.84% 2009-2-10, 16:00ET

$COMPQ Nasdaq Composite 1,524.73 -66.83 -4.20% 2009-2-10, 16:00ET

$INDU Dow Industrial 7,888.88 -381.99 -4.62% 2009-2-10, 16:00ET

$XAX AMEX Composite 1,402.71 -54.55 -3.74% 2009-2-10, 16:00ET

$TRAN Dow Transports 3,042.24 -161.08 -5.03% 2009-2-10, 16:00ET

$UTIL Dow Utilities 370.04 -11.05 -2.90% 2009-2-10, 16:00ET

Major Indices Close Change % Chg Date

$SPX S&P 500 827.16 -42.73 -4.91% 2009-2-10, 16:00ET

$RUT Russell 2000 445.77 -22.17 -4.74% 2009-2-10, 16:00ET

$NDX Nasdaq 100 1,229.29 -52.36 -4.09% 2009-2-10, 16:00ET

$OEX S&P 100 390.26 -19.92 -4.86% 2009-2-10, 16:00ET

$SML S&P Small Caps 234.32 -11.49 -4.67% 2009-2-10, 16:00ET

$MID S&P Mid Caps 505.55 -23.82 -4.50% 2009-2-10, 16:00ET

$DJA Dow Composite 2,800.19 -127.54 -4.36% 2009-2-10, 16:00ET

$RUI Russell 1000 449.07 -22.73 -4.82% 2009-2-10, 16:00ET

$RUA Russell 3000 478.16 -24.18 -4.81% 2009-2-10, 16:00ET

$VLE Value Line 1,302.05 -70.85 -5.16% 2009-2-10, 13:15ET

$WLSH Wilshire 5000 8,379.29 -410.21 -4.67% 2009-2-10, 16:00ET

AMEX Select Sector SPDRs Close Change % Chg Date

XLB Materials 21.56 -1.01 -4.47% 2009-2-10, 16:00ET

XLV Health Care 26.42 -0.91 -3.33% 2009-2-10, 16:00ET

XLP Consumer Staples 21.58 -0.72 -3.23% 2009-2-10, 16:00ET

XLY Consumer Discretionary 19.12 -0.95 -4.73% 2009-2-10, 16:00ET

XLE Energy 47.34 -2.31 -4.65% 2009-2-10, 16:00ET

XLF Financial 8.89 -1.01 -10.20% 2009-2-10, 16:00ET

XLI Industrial 20.41 -1.13 -5.25% 2009-2-10, 16:00ET

XLK Technology 15.36 -0.65 -4.06% 2009-2-10, 16:00ET

XLU Utilities 28.88 -0.84 -2.84% 2009-2-10, 16:00ET

US Industry Indices Close Change % Chg Date

$XAL Airlines 19.66 -0.88 -4.28% 2009-2-10, 16:00ET

$BKX Banks 26.74 -4.30 -13.85% 2009-2-10, 16:00ET

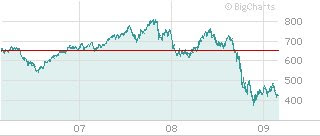

$BTK Biotechs 693.06 -20.16 -2.83% 2009-2-10, 16:00ET

$DJUSCH Chemicals 160.11 -6.27 -3.77% 2009-2-10, 16:00ET

$CRX Commodities 489.92 -25.29 -4.91% 2009-2-10, 16:00ET

$XCI Comp. Tech 559.23 -24.99 -4.28% 2009-2-10, 16:00ET

$DDX Disk Drives 53.53 -2.92 -5.17% 2009-2-10, 16:00ET

$XAU Gold 123.49 -2.61 -2.07% 2009-2-10, 16:00ET

$HWI Hardware 168.88 -9.12 -5.12% 2009-2-10, 16:00ET

$HCX Health Care 307.31 -10.42 -3.28% 2009-2-10, 16:00ET

$RXP Health Care Products 1,277.74 -32.88 -2.51% 2009-2-10, 16:00ET

$RXH Hospitals 288.12 -8.59 -2.90% 2009-2-10, 16:00ET

$INSR Insurance 2,986.54 -142.34 -4.55% 2009-2-10, 16:00ET

$IIX Internet 140.09 -6.61 -4.51% 2009-2-10, 16:00ET

$XNG Natural Gas 393.46 -15.13 -3.70% 2009-2-10, 16:00ET

$NWX Network 135.64 -5.35 -3.79% 2009-2-10, 16:00ET

$XOI Oil 929.53 -49.19 -5.03% 2009-2-10, 16:00ET

$OSX Oil Services 131.13 -6.92 -5.01% 2009-2-10, 16:00ET

$DJUSPP Paper 29.42 -2.22 -7.02% 2009-2-10, 16:00ET

$DRG Drugs 259.80 -7.66 -2.86% 2009-2-10, 16:00ET

$DJR REITs 118.37 -12.10 -9.27% 2009-2-10, 16:00ET

$RLX Retailers 265.79 -11.67 -4.21% 2009-2-10, 16:00ET

$XBD Broker Dealers 74.53 -6.43 -7.94% 2009-2-10, 16:00ET

$SOX Semis 217.33 -10.48 -4.60% 2009-2-10, 16:00ET

$XTC Telecoms 552.76 -24.10 -4.18% 2009-2-10, 16:00ET

$TRANQ Transport 1,683.74 -48.82 -2.82% 2009-2-10, 16:00ET

$UTY Utilities 390.23 -11.61 -2.89% 2009-2-10, 16:00ET